The RAW Mortgages offering is now more flexible than ever! We are able to consider up to 60% LTV on eligible cases completing after March 1st including:

- non-UK residents

- UK expats

- UK bridging loans

A handy guide to 60% LTV

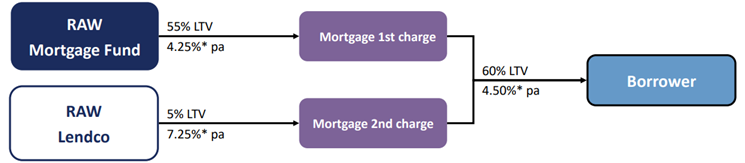

Participating loans will be split into two separate tranches. Previously, when arranging a loan of up to 55% LTV, the loan was funded by the RAW Mortgage Fund. Now, when arranging a loan of 60% LTV, 55% is provided by the RAW Mortgage Fund and 5% is provided by a new lender.

The interest charged by the two lenders creates the blended rate quoted on RAW Mortgages' rate card, which you can see here. We’ve created a handy guide to illustrate how it all works too.

*All interest rates stated are margins above Bank of England base rate (subject to a base rate floor of 0.75%). The example above is for illustrative purposes only and loan to valuation ratios and interest rates may vary.

What are the benefits?

First, the borrower is able to borrow a larger sum than previously.

Second, as the borrower can repay all or part of the loan from the new lender fee-free at any time, they can reduce the total interest rate payable and gain a direct benefit from repaying a small amount of capital.

Finally, borrowers receive the same flexible lending criteria and quick turnaround times as they always have!

Worked examples

Example 1:

Borrower A wishes to borrow £240,000 at 55% LTV. Their mortgage will come entirely from the RAW Mortgage Fund at 4.25% (plus base rate).

Example 2:

Borrower B wishes to borrow £240,000 at 60% LTV. Their mortgage will come as a loan of £220,000 from the RAW Mortgage Fund at 4.25% (plus base rate) and £20,000 from RAW LendCo at 7.25% (plus base rate) for a total loan of £240,000 at a blended interest rate of 4.50% (plus base rate). At any point during the loan term, the borrower can repay £20,000 and reduce their interest rate to 4.25% (plus base rate) without incurring additional charges.

If you would like to find out more or have an application you would like to run by our team, get in touch today to experience our fast and flexible lending services.