Pre-Borrowing - FAQs

Am I eligible to borrow?

RAW mortgages are for non-UK resident individuals, companies and trusts who require a mortgage secured against a buy-to-let property in the UK. We can also lend to UK residents on UK buy-to-let property for a maximum term of 11 months.

Do you lend to borrowers with unusual circumstances?

Yes. Unlike mainstream lenders, we have no ‘tick-box’ approach when it comes to making lending decisions, and instead look at each applicant’s personal and financial situation as a whole. We have lent to hundreds of borrowers, each with their own unique circumstances.

Do you lend to UK residents?

We offer bridging loans to UK residents for a maximum term of 11 months.

Do you only lend towards the purchase of property?

No, we also provide loans for re-mortgage and release equity from investment property

What are the interest rates?

Talk to us to find out our latest offers. We typically lend on a variable rate basis linked to Bank of England Base Rate.

On what type of property do you lend?

We lend on quality residential properties located in major towns and cities in the UK, and others by exception.

What documentation will I need to apply?

Documentation requested will depend on the applicant’s circumstances. Contact a member of our team to learn more.

What checks do borrowers undergo?

We conduct background checks including adverse media searches, credit checks and fraud checks.

What is the maximum loan term?

Our maximum term is 5 years, however we are more than happy to review cases for renewal upon maturity of the loan. If borrowers maintain their interest payments for the duration of the loan and the quality of the security has not changed dramatically, we are generally quite flexible when it comes to renewals. Our bridging loan product is made for a maximum term of 11 months but is not available for renewal.

How long will it take to get a decision on my loan?

At RAW Capital, we endeavour to maintain a fast and flexible application process. We aim to provide borrowers, or their agents, with a decision in principle within 48 hours.

Do applicants require existing UK or overseas property ownership?

No, we are happy to consider first-time landlords and enjoy helping non-UK residents get on the property ladder in the UK. However, we do take a risk-based approach for lending decisions - this means that we are able to assess applicants resident in jurisdictions that may be considered too high-risk for other lenders.

Do applicants need to be employed?

No, we do not have any requirements on employment status. We have lent to borrowers who are retired, self-employed as well as to professional investors and landlords.

Do you have a rental coverage requirement?

There is no fixed requirement. We prefer the rental income to cover the interest payments, but decisions are also dependent on the income and assets of the borrower, as well as the quality of the property.

Are there any restrictions on new builds?

We do not have any official restrictions on new builds. We review each enquiry on a case-by-case basis, taking into account the quality and location of the property.

Are there any restrictions on the height of the building?

We do not have any official height restrictions. Each enquiry is looked at individually, as it depends on the location and quality of the building.

What are the application fees involved?

For UK buy-to-let mortgage loans, arrangement fees start at 1.5% of the requested loan amount, with a minimum of £2,500, payable on application. For bridging loans, arrangement fees start at 2% of the requested loan amount. The cost of the professional independent valuation and legal fees are also borne by the borrower and vary depending on the size of the loan.

Are there any other fees payable?

Annual review fees of £500 are paid in respect of each loan, throughout the duration of the term.

Can I use my solicitor?

You are entitled to use your own solicitor for any transaction. If you are applying for a loan to assist with the purchase of a property, we may choose to appoint your solicitor to act on our behalf. Also, if you are applying for a loan to refinance or release equity, we will always appoint our own solicitor.

What is the Bank of England Bank Rate?

The Bank Rate determines the interest rate The Bank of England pays to commercial banks that hold money with it (which they typically do overnight every day). It influences the rates that those banks then charge people to borrow money or pay on their savings. RAW Mortgage loans are ordinarily linked to Bank of England Bank Rate

Why does the Bank of England Bank Rate change?

The Bank of England reviews Bank Rate 8 times per year, and it is used as a means to influence the UK economy.

Will you notify me of a change in the Bank of England Bank Rate?

Once the Bank Rate has changed an email of notification will be sent confirming the new rate, your new monthly/quarterly payment amount and the additional interest that is applied.

How will the Bank of England Bank Rate changing affect my loan/mortgage?

In line with the Terms & Conditions of your Loan Agreement(s), the interest rate on the mortgage loan(s) secured on your property will reflect the new rate if you have a Tracker mortgage with us. You will be notified each time a Bank Rate changes and your interest reminder, sent around the 13th of every month, will reflect the new rate. Please ensure you review your interest reminders each month/quarter and pay the amount requested to ensure no penalty fees are applied.

What is the Additional Interest?

As we apply interest in advance each month, the additional interest is based on the date the base rate changes and the remaining days left in the month to be charged at the newer rate.

Existing Borrowers - FAQs

What is a Loan ID?

A Loan ID is the unique reference we use to identify an individual loan.

How is a Loan ID created?

A Loan ID is comprised of the first 5 letters of the borrower’s last name, a unique 4-digit number, and the year when your loan began.

e.g. David Robinson's Loan ID 'Robin 3456-2024'

What if my loan is in the name of an entity or business?

The first 5 letters of your Loan ID will comprise of the first entity on your loan agreement. Therefore, it is common that the first 5 letters of your Loan ID will be in the name of the relevant company.

e.g. Clubhouse Limited with UBO David Robinson will have Loan ID ‘Clubh 3456-2024’

Where can my Loan ID be located?

Your Loan ID can be found:

- At the bottom of the front page of loan agreement

- Within the subject line of all email correspondence from RAW

What can I do if I cannot find my full Loan ID?

Don’t worry – there are other ways we can identify you and your loan!

What is a mortgage statement?

A mortgage statement is a detailed record of all transactions on your mortgage account that relate to interest, fees or, where applicable, interest on account.

Can I request a mortgage statement?

Yes! You can request a mortgage statement at any time by contacting [email protected].

You will also receive a mortgage statement attached to every periodic interest reminder.

What is my mortgage statement password?

Your encryption password is the postcode of the subject property. This password is all caps, with no spaces.

Where can I locate my mortgage statement password?

This postcode can be found within the definitions section loan agreement. Please note, this postcode may vary slightly to the postcode with which you are familiar, so it is important to use the postcode as stated in the Loan Agreement.

Why can I not access my mortgage statement?

The mortgage statement that we provide in out periodic correspondence requires you to enter a passcode. This passcode is the postcode of the property against which your loan is secured.

Who can I contact if I have a question regarding my current loan?

During loan term: [email protected]

When are my interest payment due?

Monthly payers- your payment is to be received in our account by 24th of each month.

Quarterly payers - your payment is to be received in our account by 24th March, June, September, and December.

How early can I send in an interest payment?

We recommend awaiting your periodic interest reminder before remitting payments, in order to ensure that you are remitting the exact amount owed. As such, we recommend that the 13th of each month, or pay period is the earliest date for making payments.

I would prefer to make large, infrequent payments – can I?

Yes, we allow overpayments of interest. These funds will be posted to your account and be used to cover future interest charges.

How much interest do I owe?

Monthly Interest payments – you will receive an ‘Interest Reminder’ email on 13th of each month, or closest working day advising the amount to pay.

Quarterly Interest payments – you will receive an ‘Interest Reminder’ email on 13th March, June, September and December, or closest working day advising the amount to pay.

How is my interest calculated?

Interest is calculated based on the average number of days in a month during a 360 day calendar year. Please see below example.

Monthly Interest = Loan Amount x Interest Rate x (30.4375/360)

Example:

Loan amount: £100,000, Interest rate: 9.5%.

Monthly Interest = £100,000 x 0.095 x (30.4375/360) = £803.21

What is a non-UK payment?

This is defined as any payment where the funds originated outside of the United Kingdom (England, Scotland, Wales and Northern Ireland).

Can I pay from a UK Bank Account?

We can only accept payments from a UK Bank Account in certain circumstances – contact us to discuss whether you are eligible.

Can I make an early or partial repayment of my loan?

Yes. Partial repayments must be over £10,000 or 10% of your total loan value. A fee may be charged; please see clause 7 of your loan agreement for more information.

What penalties do RAW apply?

- Penalty Fee for Notice of Default

- Penalty Interest

What is a Notice of Default fee?

In an ‘Event of Default’, RAW Capital Partners charges a communication fee to cover email, phone and postal correspondence relating to the Notice of Default. This is posted onto your mortgage account as ‘Penalty Fee for Notice of Default’. The fee is £150.

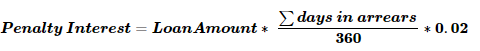

What is Penalty Interest?

This ‘Event of Default’ triggers the Penalty Interest clause within your Loan Agreement under clause 5. Penalty Interest is charged at 2% above your mortgage rate for all days where your loan is in default. Penalty Interest will continue to be charged until the Event of Default is rectified.

How is Penalty Interest calculated?

When is Penalty Interest charged?

Penalty interest is always charged at the start of the month, for all events of default within the previous month. For example, if you have rectified an event of default by February 13th, you will receive a penalty interest charge on (or around) March 1st for all days in default until February 13th.

We are sympathetic to any difficulties that you may be having when making interest payments. If you feel that a Notice of Default has been issued erroneously, or that you have reasonable justification that your circumstances are exceptional, then you should contact [email protected] within 48 hours of receipt.

What other charges can I incur?

If you do not pay your council or legal obligations (e.g. Service charges or Ground rent), RAW Capital Partners may pay these to protect our interests. In this event, we will charge a 20% uplift on these fees, for the service that we are providing. This will be payable to the account to which you usually make interest payments.

How do I obtain a copy of my Building's Insurance documents?

We require valid Building’s Insurance Schedule and Policy Wording.

Flat/apartment - you will need to request a copy of the Building’s Insurance Schedule and policy wording from your Property Management Company.

Freehold property - you will need to arrange your own Buildings Insurance cover.

How much is the Annual Review Fee?

The Annual Review Fee is defined in Schedule 2 of your Loan Agreement.

When will I be charged an Annual Review Fee?

You will be charged an Annual Review Fee in the anniversary month of your loan start date every year until your loan end date.

What does the annual Review fee cover?

An Annual Review fee is charged each year on the anniversary of your loan. The amount charged is defined in Schedule 2 of your Loan Agreement.

The fee is to cover administrative tasks completed by RAW Capital Partners to monitor and manage risk on behalf of the RAW Mortgage Fund and its investors throughout the year.

Why am I being asked to provide a Bank Statement?

Sometimes, we may ask you to provide certain documentation relating to a payment or bank account. We must fulfil our regulatory requirements as a matter of priority. Usually, we need a bank statement to prove that you own a certain bank account, or that the bank account is NON-UK.