Overview

The RAW Mortgage Fund is a specialist debt fund with over £200m of investor assets and has a 10 year track record of positive monthly performance.

The investment objective is to provide an attractive and consistent level of dividend income or capital growth along with a high level of capital security. Risk is managed carefully via conservative lending standards, rigorous credit assessment and ongoing monitoring.

We identify low-risk mortgage lending opportunities on quality residential property located in major towns and cities in the British Isles, which are more easily let and more easily sold, even during economic downturns.

The Fund does not lend on high-value properties in London or elsewhere, nor does it lend against development properties or land which typically carries higher risk. The Fund lends to a maximum average of 60% of property valuation across the portfolio and up to 70% of the property valuation on any one property.

Performance

The aim of the Fund is to achieve a consistent risk premium above the Bank of England Bank Rate, for institutional investors. The majority of lending is variable rate, each loan agreement also has a rate floor, so if the base rate rises so should returns to investors.

Since its inception in May 2015, the Fund has recorded a positive performance every month and has comfortably outperformed its benchmark (the 0-5 year corporate bond index).

Institutional accumulation share class:

Portfolio

Average loan to valuation

Asset allocation by loan value

- < £250,00040%

- £250,000 - £500,00026%

- £500,001 - £1 million20%

- > £1 million14%

Loan value by geography

- Greater London63%

- Other SE England8%

- Rest Of UK24%

- Channel Islands/IoM5%

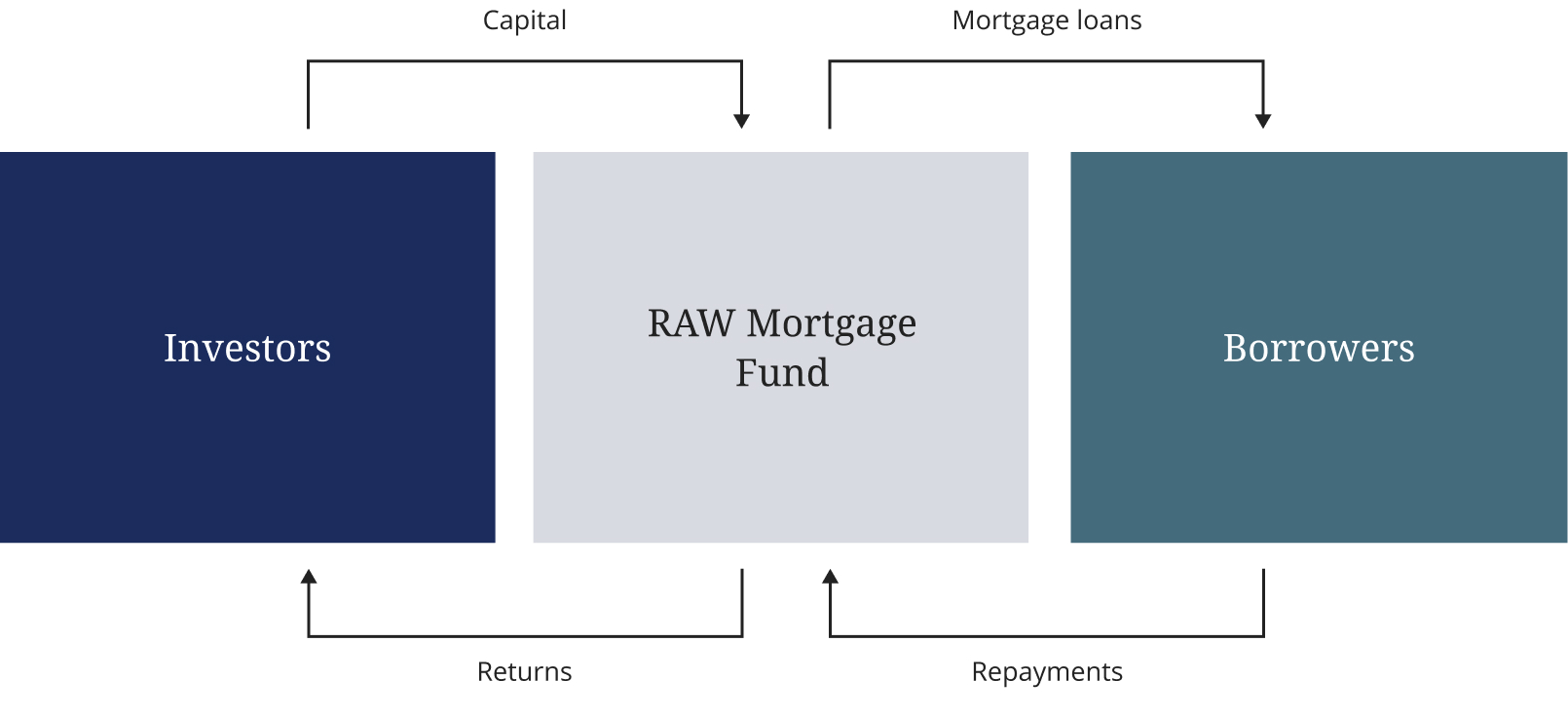

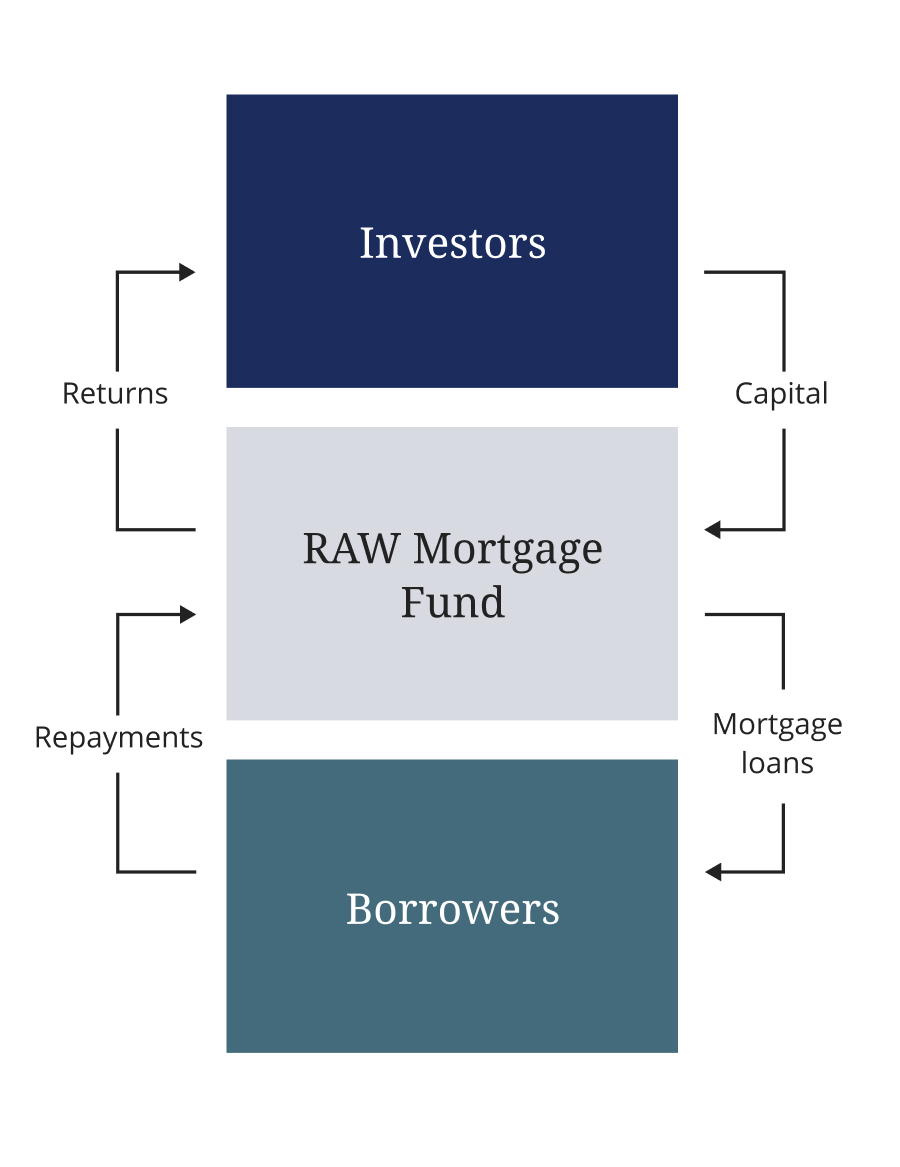

How it Works

Mr Smith has a deposit equal to 40% the purchase price of an apartment in a major town or city in the British Isles that he wants to buy-to-let. He borrows the other 60% of the purchase price of the property from the Fund.

Mr Smith owns the property, so he receives rental income arising from the property and benefits from any increase in its value.

The Fund receives the mortgage interest payments from Mr Smith. The Fund also takes security via a first legal charge over the apartment. Investors are therefore protected from the first 40% of any loss in capital value of the property in the event of default.

Benefits and Risks

Benefits

- Consistent investment performance and returns for investors from a well-established investment strategy.

- Low volatility. The value of the Fund does not fluctuate up and down like the stock market or many equity-based investments.

- Strong protection for your capital from underlying loans secured against residential property in the British Isles, the Fund has a first legal charge in each case.

- The Fund lends against residential property, much like a building society, at low loan to valuation ratios with a maximum average of 60% and a maximum of 70% loan to value on a single property.

- Property values would need to fall very significantly before there was a major negative impact on the capital value of the Fund.

- Directors of the Investment Manager and its shareholders are significant investors in the Fund.

- All properties are valued independently by a hand-picked panel of RICS qualified valuers or using reliable data driven models. Solicitors are used to complete transactions and security checks.

- All loans made by the Fund are carefully considered by an experienced Credit Committee.

Risks

- Depending on the Share Class you choose, a minimum of 1, 3 or 6 calendar months written notice of withdrawal, prior to redemption dealing day, is required to access your capital.

- Redemption proceeds are only available after independent calculations of the Fund valuation have been completed, checked and agreed. This process takes approximately 10 working days after a calendar quarter end.

- Any investment in the Fund is not protected by the Guernsey Banking Deposit Compensation Scheme.

- The Fund makes mortgage loans secured against residential property, much like a building society. These loans are each typically for 5 years. Therefore, there is a possibility that investors might have to wait longer for redemptions than the specified notice period.

- If there was a very significant decline in UK house prices, the capital value of the Fund could be impacted. This may result in losses for investors.

- There are no guarantees that the historic performance of the Fund can be repeated in the future.

- Professional counterparties, such as valuers and solicitors, can make mistakes (however, we do check their professional insurance cover thoroughly).

- Not all risks can be foreseen and so there are other potential risks that may impact the performance of the Fund and the value of your investment.

Key Facts

Fund details

Fund structure

The RAW Mortgage Fund is a cell of RAW Alpha PCC Limited, a protected cell company registered with limited liability in Guernsey on 10 December 2012 having registration number 55993.

The Fund is authorised as an open-ended Class B scheme by the Guernsey Financial Services Commission.

Management fees & charges

The Investment Manager will charge a single transparent management fee in each share class. The Fund will also bear the cost of the Fund's Administration, Custody, Audit and Directors which equates to c0.19%.

Further details of these management fees, administration and transactional fees are included in the Prospectus (known as the Scheme and Supplemental Particulars) for the Fund which we will be delighted to send to you on request.

Please call us on +44 1481 708250 or email the team [email protected]

Corporate governance

Assets are held in the name of the Fund and are under the control of its Custodian or SPV Custodian. The Fund's assets are valued independently by a professional fund administration firm, as required by regulation. The administrator is also responsible for reporting to investors and for ensuring fair treatment of investors in line with the Prospectus. The Fund is domiciled in Guernsey and oversight of the Fund is provided by an independent board of directors.

RAW Capital Partners Limited is responsible for managing the assets of the Fund and is the SPV Custodian, it is regulated by the Guernsey Financial Services Commission (2101792). RAW Mortgage Fund is a cell of RAW Alpha PCC Limited which is an authorised collective investment scheme regulated by The Protection of Investors (Bailiwick of Guernsey) Law, 1987, consolidated (2103625) by the Guernsey Financial Services Commission.

Fund Custodian - Butterfield Bank (Guernsey) Limited

SPV Custodian - RAW Capital Partners Limited

Fund Administrator - Vistra Fund Services (Guernsey) Limited

Auditor - Grant Thornton

Independent Governance - Fund Board

Regulator - Guernsey Financial Services Commission (GFSC)

Multiple Borrowing Counterparties - Multiple Properties as Security

Ready to start investing?

The RAW Mortgage Fund is a specialist mortgage lending fund designed to provide an attractive and consistent returns with a high level of capital security.

Click below to find out how you can start investing.

Want to learn more about investing?

Get your free investor pack direct to your inbox.

Buy-to-let mortgages

Buy-to-let mortgages specially constructed for Non-UK residents wishing to invest in the UK property market.