Insurance companies

Insurance companies pool the capital of many policyholders with similar risks (e.g. car accidents, manufacturing insurance, fire, flood…) to protect those few who experience a loss.

To ensure they are in the position to protect those unlucky few, insurance companies are obliged by regulation to hold large amounts of capital on their balance sheets. Insurance companies are keen to invest this capital to 1) protect its value from the effects of inflation and 2) improve overall profitability.

However, since the financial crisis, regulation has been put in place to discourage insurers from taking too much risk (in Europe, the regulation is called Solvency II). The regulation works as follows: if an insurance company invests in a risky asset (such as stocks and shares) it must hold cash to protect it (and its policyholders) against the risk of a fall in the asset’s value.

Cash produces little or no return, and neither protects against inflation nor improves profitability.

By comparison, the RAW Mortgage Fund (“the Fund”) is a very low-risk and low volatility investment:

- there is transparency through to the underlying debt investments;

- the debt investments produce consistent contractual cash flows; and

- the debt investments are secured against UK residential property at loan to valuation ratios (LTV) of 55% or less

Insurance companies therefore need to hold little cash alongside the Fund to meet their regulatory obligations and can therefore enjoy an attractive blended return.

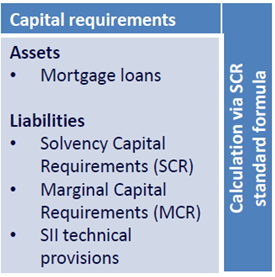

Solvency Capital Requirement (SCR) for RMF

The Fund offers a highly capital efficient investment for insurance companies subject to Solvency II and similar regulations.

For example, under Solvency II:

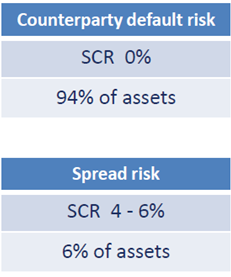

- the majority of the Fund’s assets are made up of mortgage loans of less than Euro1 million and are all below 60% LTV, which have a zero-capital charge under the counterparty default risk module; and

- a small proportion of the Fund’s assets are made up of mortgage loans of greater Euro1 million, which attract a slightly higher capital charge of 4-6% under the spread risk module.

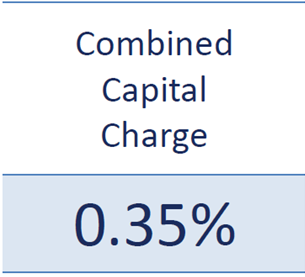

The combination is a Combined Capital Charge of c. 0.35%.

RAW Capital Partners can provide regular, transparent reporting to insurance companies to assist with their Solvency II regulatory reporting.

Pension funds

Like insurance companies, pension funds must invest prudently today to meet costs paying member’s pensions) far into the future.

Pension funds pool the capital of members and invest it prudently such that they may enjoy a comfortable retirement. Pension funds are run by local councils, large corporates, or by private pension providers.

Pension funds typically invest in a broad range of investments but will always include some low-risk and/or cash generating investments:

- as members get close to retirement age, low risk investments are useful to lock in the value of their investment

- once they reach retirement age, cash generating investment are useful to fund the member’s regular pension payments

The RAW Mortgage Fund is a low risk and low volatility investment, which generates predictable contractual cash flows.

Some pensions (called “defined benefit” or “final salary” pensions) used to guarantee their members a certain amount of income in retirement but most closed to new members years ago. More recently, the main aim of pension funds is to ensure that the value of their members’ capital is not eroded by the effects of inflation.

The floating-rate or “tracker” mortgages in which the Fund is invested provide some protection against inflation as its cash flows rise with interest rates (and interest rates typically rise with inflation).

How the RAW Mortgage Fund works

The Fund is much like a building society in a fund structure – it takes capital from investors (rather than savers) and lends it secured against UK residential property. A type of “debt” fund.

This lending creates returns for investors with a high level of capital security (from a first legal charge registered against each property). RAW Capital Partners originates and manages each loan.

The average loan to property valuation from the Fund is only 47% (March 2022) and is limited to 55% maximum on any one loan.

There has been no bad debt or write-offs of any loans since the Fund launched in 2015.

Investment returns are very consistent

Click below to see the latest performance data and to find out how to apply